New Rules for Broker Fees Shake Up the Industry

New guidelines aimed at making real estate transactions more transparent went into effect Aug. 17 and buyers will now directly pay an agent who helps them purchase a house, and sign a contract promising to do so. Previously, sellers paid for their own agent, and that agent generally split the 5-6% commission on a home sale with the buyer’s representative, which works out to $20,000-24,000 on a $400,000 property.

The changes have caused a fair amount of agita among real estate agents, many of whom are concerned about how their fees will be sorted out in the new world. The upshot is that buyers will be able to negotiate how much they pay their agents.

“At the end of the day buyers agents will still get paid,” said Wade Shoop, an Austin-based real estate broker with 19 years of experience. “The NAR settlement just put a focus on how commissions are paid and who pays them. Commissions have always been negotiable and I don’t see there being any major changes to the amount of commissions being paid.”

“For me the big change is buyer agents are going to have to provide more value,” Shoop added, “and that will hopefully get brokers more engaged with new agents to better represent their client base.”

A lawsuit filed by a group of Missouri home sellers that went to trial in October of 2023, accusing the National Association of Realtors and brokers of colluding to artificially inflate real-estate commissions, spurred the change. The jury sided with the plaintiffs, imposing fines and requiring the NAR to make changes to the way its agents operate.

As part of a landmark $418 million settlement, home buyers must now sign an agreement that states how much they’re willing to pay their agent — and for what services — prior to house hunting.

“We have a lot of buyers who are finally asking questions, which I actually like,” Michael Perry, a Salt Lake City-based real-estate agent with the Perry Group of the Real Brokerage, told CBS MarketWatch.

“It kind of turns the lights on to compensation, and buyers are starting to negotiate more,” he added. “So we’re able to give a better customer experience by having that compensation conversation.”

It’s unclear if this all will have any effect on the prices of homes, but few in the industry expect any significant impact.

Proptext.co reached out to a top agent at the prominent New York agency Brown Harris Stevens and was told agents were not to comment on the new ruling and the company had no comment. The Real Estate Board of New York, the reigning trade group, is not a part of NAR, and most of the big brokerages based in the city are REBNY members.

However, REBNY opted into the NAR settlement in June since it was facing two antitrust commission suits, prompting a judge to pause them. Agents in the city are closer to following the deal worked out with NAR, so it seems that settlement will impact the industry across the US, according to The Real Deal.

Rob Hahn, a real estate industry consultant based in Las Vegas, told Newsday, the newspaper that covers Long Island, that agent commissions were unlikely to be lower in the near term but over time some buyers’ agents could start charging less, pushing costs down.

In a seller's market like Long Island's, where home prices have hit records this summer, homeowners would likely do even better, according to Hahn, who is a Long Island native.

“I do think most of the economic benefit will be captured by the seller,” he said.

Goldilocks Rental Terms With Higher Returns

Airbnb is the dominant rental story of the last decade or so, an app that challenged the hotel industry, created a new asset class, and spawned a company with an annual revenue of nearly $10 billion and a profit margin of 48 percent.

Most investors who are not crazy about the management issues that arise with short-term rentals think long-term: getting tenants into an empty space signed to a one- or two-year lease.

But what about a Goldilocks rental time frame, neither too long, nor too short? Say any period between 1 to 11 months? These are called mid-term rentals, and they offer a higher return on investment than a long-term lease — as much as 20-30% —and can give an owner the flexibility to use the property between tenants, while not having to worry about turning it over constantly.

The upfront costs of furnishing a rental property are higher, but can be recouped in fairly short order.

Furnished Finder, which was founded in 2014, originally catered to travel nurses and other medical professionals. Now charging $149 a year, it has more than 200,000 landlords on the platform and sees more than 21 million searches a year.

AirDNA has reported that the number of mid-term rental listings on major platforms (including Airbnb) has increased by about 20% annually since 2020.

Greater Flexibility, and a Higher Return

For Kermit Walder, a technology marketing executive and part-time real estate investor from New Jersey, a condominium purchase in Portland, Maine, gave him the opportunity to try a mid-term rental.

“We wanted the flexibility to be able to use the property between renters,” Walder said, “and at some point maybe spend a lot of time up there and have it fully furnished.”

He calculates his rental premium at just shy of 20 percent, and has two medical professionals who rented the two-bedroom apartment in the downtown arts district on a seven month term for $3,250 per month.

“If we were doing an annual lease on an unfurnished place, we’d get less,” Walder said. “This way we have a better chance at covering our expenses.”

Walder bought and flipped a duplex a decade ago, a sale he now regrets. He owns and self-manages with a partner a mixed-use building in Hackettstown, NJ, with two long-term tenants and two restaurants, one a Domino’s pizza franchise.

The Portland condo was a chance to try something different.

“There’s a lot of work getting it furnished, and extra costs associated with that,” he said. “There’s risk associated with short-term tenants. There’s added work to renew the leases, and cycles come up more quickly.”

Also, there is the seasonality factor.

“Maine and Portland are not the biggest draw weather-wise from November to April,” Walder said. “I’m fully expecting we might have to drop the rent in that period.”

But in their favor, the tenants he is seeking are not as sensitive to the weather. And most MTR renters are professionals who are not looking to throw weekend parties.

“We’re not renting to people necessarily looking to vacation,” he said. “We’re looking for travel nurses and digital nomads.”

The tools on Furnished Finder are useful, and it’s possible to conduct background checks on potential tenants.

Macro Factor Drive Demand for MTRs

Luke Bujarski, founder and principal at LUFT, a strategic marketing firm specializing in real estate and hospitality, guest wrote a post recently about MTRs in the Substack newsletter Thesis Driven.

He said advancements in technology — digital locks, cameras, sensors, tenant screening and booking, marketing, property management systems, and other operational tools — are making it easier and safer to manage MTRs. Regulatory issues are generally less intrusive with MTRs vs. STRs as well.

Bujarski also cited macro trends that are benefiting the MTR space, including:

A growing number of upper income earners (up six percentage points in the U.S. between 2010 and 2021 according to trade.gov)

Declining birth rates among young professionals

A renter/mobility mindset amongst young professionals

International visitor numbers to the U.S. are rising steadily

The adoption of hybrid and remote work, allowing workers to be more flexible with their living arrangements.

There are other factors that favor MTRs for some investors, including the fact that occupancy rates for MTRs range from 80-90%, as opposed to 50-70% for STRs in urban markets, according to research from Gartner.

The term digital nomad was first popularized in 1997 by the book with that title by Tsugio Makimoto and David Manners — with a futuristic cover and a title that seemed ahead of its time. There were 4.8 million digital nomads in the US in 2018, 17.3 million in 2024, and the number is expected to hit 36.2 million next year.

The appetite for MTRs shows no sign of letting up.

Furnished Finder now has some 275,000 listings on its platform. Airbnb reported that midterm rentals listings grew 25% year over year from 2022-23.

Real Estate Maxim Holds True: Finding the Right Deal Is Crucial

Walder had been eyeing the Portland market for some time before he found a condo that had been lingering for a few months, with an owner who had already purchased another property. So he came in with an offer $25,000 below asking and it was accepted.

“It’s all about finding the right deal,” he said. “Fifty percent of the work is finding the right deal, and that’s a lot of work.”

The costs of residential property are so high these days it’s hard to find a deal that pencils with a profit.

“It would take a while for this property to be generating income,” Walder said. “But if we upgrade the kitchen and add a full bath, we can charge more.”

He plans to increase his revenue during the prime rental season — June to August — next year and “explore being more tactical in who we get in there and when, and probably bump the monthly rent up.”

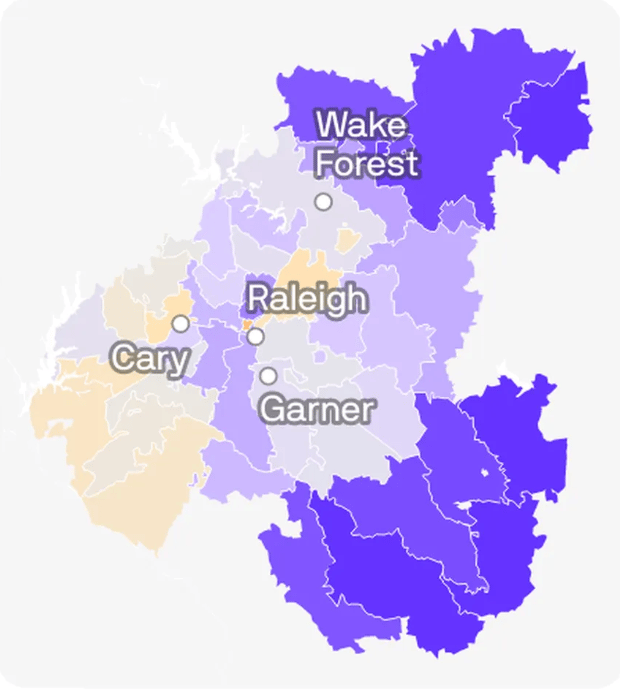

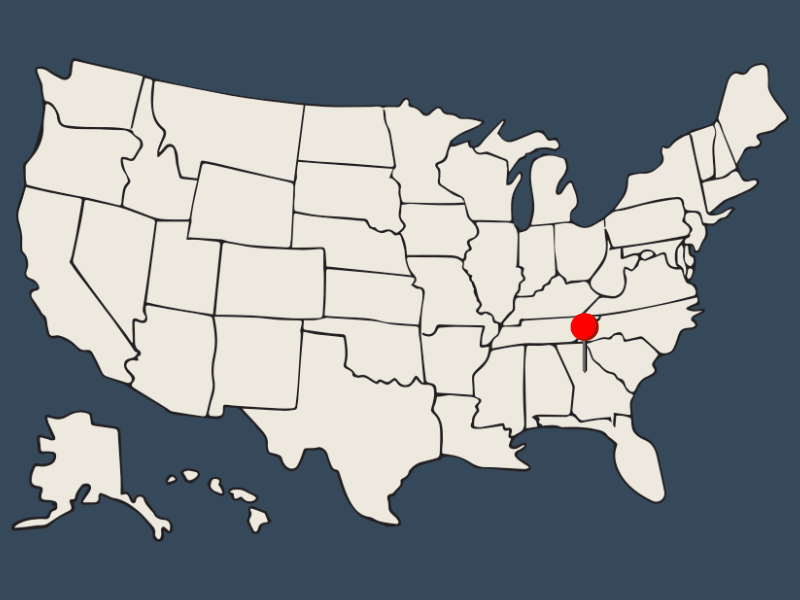

Raleigh, North Carolina

Raleigh stands out as a prime location for real estate investment, particularly in the single-family residential (SFR) market. As of 2024, the city's housing market shows strong resilience and growth potential, with home values continuing to rise.

The average home value in Raleigh is approximately $434,407, reflecting a 3% increase over the past year. Homes in the area typically go under contract within 19 days, highlighting the competitive nature of the market.

Raleigh’s economic stability is underpinned by a strong job market, driven by industries such as technology, education, and healthcare. The city is part of the Research Triangle, a hub for research and development, which attracts a skilled workforce. This inflow of talent has contributed to a population increase and sustained demand for housing.

The area’s demographics are also favorable for long-term investment. Raleigh has a diverse population with a significant portion of young professionals and families, ensuring a steady demand for both rental properties and homes for sale. Additionally, the city’s quality of life — bolstered by good schools, parks, and cultural amenities — makes it an attractive destination.

The planned Apple campus in Cary, North Carolina, will have a significant impact on the local economy and real estate market. Announced in April 2021 and expected to be complete in 2027, Apple committed to investing $1 billion in the Research Triangle area. This campus is expected to create at least 3,000 new jobs, primarily in technology fields such as machine learning, artificial intelligence, software engineering, and other high-paying tech roles.

Key Neighborhoods

Downtown Raleigh: High demand area with ongoing development projects. Property values are higher, but so is the potential for appreciation.

North Hills: An upscale area with a mix of residential, retail, and office spaces. Strong rental demand from professionals.

Southwest Raleigh: More affordable with potential for higher yields, though slightly riskier in terms of tenant quality.

Some Risks and Other Pitfalls to Avoid

The healthcare sector plays a significant role in the Raleigh economy, with approximately 13% of the total workforce in the Raleigh-Cary metro area is employed in the education and health services sector. This sector has also been one of the fastest-growing in the region, reflecting both the area’s expanding population and the increasing demand for healthcare services.

Raleigh's economy is also heavily tied to technology and education. While these industries are generally stable, any significant downturn — such as budget cuts in education or shifts in the tech industry — could impact job growth and housing demand. Any change to the US healthcare industry, driven by a new administration, could have outsized effects on the economy of Raleigh and have a knock-on effect on housing demand.

1001 Highlander

Tucked away on a tranquil cul-de-sac, this enchanting 0.70-acre property provides a serene, mountain-like atmosphere while still being conveniently situated in an established neighborhood close to shopping. Impeccably maintained and ready for move-in, the home features a charming rocking chair front porch, a spacious two-tiered deck, and a modern kitchen with a breakfast bar, glass tile backsplash, and bay window. The first floor is highlighted by elegant chair rail molding and newly installed hardwood floors (2019) in the entryway and dining room.

The Investment Thesis

→ Updates include Roof (2019), HVAC downstairs (2021), HVAC upstairs (2024), Hot water heater (2023)

→ Easy access to I-40

→ On the southern end of Raleigh where population growth is higher

Property Details

Yr Built: 2000 | Type: SFR |

Sqft: 1,806 | Bed/Bath: 3, 3 |

Financial Projections

Asking Price: $399,000 | 5 Yr Appreciation: $97,227.59 |

Revenue: $24,708 | Annual Gross Income: $21,288 |

Interested in Learning More?

*Appreciation based on 4.5% growth rate.

Aaron’s Co-Living Strategy That Led to 33 Units in Atlanta

Aaron Shoemaker bought his first home when he was only 22, a place in Colorado Springs when he was stationed at Fort Carson.

Now 36 and married with three young children, Shoemaker owns 33 properties in the Atlanta metro area with two partners and rents about 80 percent of his inventory as co-living spaces.

As a young father, real estate provides him with the flexibility he wants. He recently spent 5 weeks in Quebec with his family to escape the summer heat in Atlanta.

After graduating from University of Florida, where he trained in the Reserve Officers' Training Corps (ROTC), he spent five years as an intelligence officer with the Army, including a one-year tour in Iraq and nine months in Afghanistan.

“This was tough on the family,” Shoemaker said. “I knew I wanted to do something in business and I liked real estate.”

He bought his first rental property in his hometown of Pensacola, Florida in 2012, where the skills he learned helping out in his father’s construction business came in handy. He did most of the renovation work himself, and also at his first few properties.

From 2014-16, he went to Wharton, where he earned an MBA, then worked at Boston Consulting Group from 2016-18.

“All along that little rental property was paying us every month,” he said.

He wanted to do something more entrepreneurial and took on a consulting role, and bought a second property in 2019, then a few more in 2020. He worked with his partners to scale up the business during the pandemic.

“You had to be creative to make a deal work since prices were skyrocketing,” he said. “Co-living became our answer.”

Shoemaker said what he learned at Wharton does not necessarily apply to his real estate business.

“It comes down to whose pots and pans go in which drawer,” he said. “At this level of tactical management it’s just practical problem-solving.”

One piece of advice he likes to share: “Everything I’ve sold I regret selling.”

This interview has been edited and condensed for clarity.

What is your special real estate power?

I think it’s the management. We’ve always self-managed and I think that’s helped us do a better job marketing and maintaining these properties and keeping good tenants. Especially with co-living, things can go bad really quickly. I have three remote workers — 2 manage operations and do maintenance and lease renewals. One exclusively does leasing.

What was the hardest lesson you learned early on in your real estate journey, and how did you overcome that and persevere?

I have done well at buying, renovating and holding rentals. I have not done well on flips. I recently lost $50,000 on a flip. So the lesson is to stick with your strengths. We paid too much and we went too premium, and then we got hit by higher rates. We also made some poor tenant decisions before and we paid the price, damaged homes and evictions. I had my job to help carry us through, but that could have been the end of my investment journey if things turned out different.

What advice would you offer to somebody looking to get into real estate or grow a portfolio?

I helped a couple friends get their start in real estate investing. If you are just starting, think about what you can do with your own home. Rent out the basement. We have an in-law suite in our home. There are different ways to “house-hack.” That can help you build the starter capital to do the next deals. It’s tough to do something in today’s market without being creative. Short-term-rentals and co-living — you need to understand what it’s really like because it takes a lot of management. Real estate is a great entrepreneurial training opportunity for your kids. That’s a great thing to give your kids a spark in life.

Among the strategies a property owner could pursue — long-term rental, mid-term rental or short term, (Airbnb), co-living — what works best for you, and why?

Co-living works best for us, but it’s not necessarily short term, because our average tenure is over two years. We made very nice places to live at an affordable rate. We stay involved to manage those issues that arise with roommates that do not know each other. The cash-on-cash return is similar to short-term-rentals. There is such a need for affordable housing. You need to make $25 an hour to afford a studio apartment in Atlanta, which is three times the minimum wage. We enjoy providing good housing to people. With co-living, the average cap rate is around 10% and we’re playing in a niche with 10% cap rates and we like it there. We use various platforms to advertise, including Padsplit, Zillow, Roomies.com, Furnished Finder, and Facebook.

What do you think is the biggest issue investors face in 2024 and beyond?

I think it is a political climate restricting the rule of law, particularly in enforcing evictions. Georgia was known as a business-friendly state but there are counties in metro Atlanta that do not devote the resources to enforcing evictions or are actively working to slow them down.

According to Georgia squatter law — once you have a writ of possession, counties have to publish a list of off-duty marshalls. Fulton and Dekalb counties have yet to publish those lists.

What’s your sense as to where the market is going, vis a vis, rates, prices, valuations, appreciation, etc.?

Starting from the macro outlook — the US is still the best place to do business for the next 20 years. Demographics and economic trends make me bullish on the US. We are starting to see rates moderating and prices come down in Atlanta. It’s a very hard time right now, but you have to start getting into the game at some point.

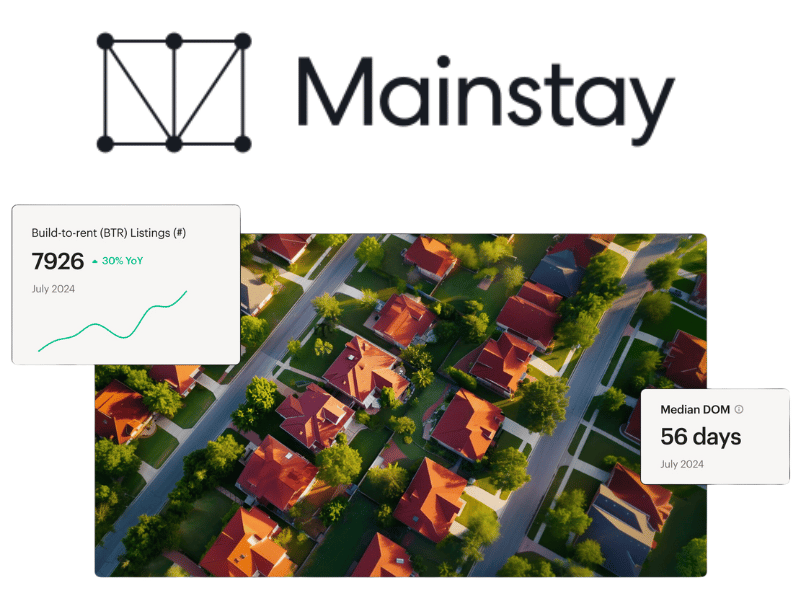

Mainstay

Mainstay is a comprehensive market intelligence and transaction platform designed specifically for the single-family rental (SFR) industry. The platform offers robust data solutions for both consumers and institutions nationwide, along with transaction services in some of the most popular markets for SFR investors, including the Sunbelt region and surrounding areas.

Origin Story

Mainstay, originally known as Open Exchange, began as a business line within Opendoor to address the needs of institutional customers using Opendoor's inventory flow to build their SFR portfolios. Launched in 2016 under the leadership of Dod Fraser and Nate Harbacek, Mainstay has since evolved into a separate entity with a new round of funding led by Khosla Ventures, which has been a key supporter of Opendoor’s through multiple fund-raising rounds.

A pioneer in the iBuyer space, Opendoor has been instrumental in reducing friction in the buying and selling process for everyday homeowners. One of the significant outcomes of this initiative has been the creation of a unique competitive advantage in the real estate industry by successfully securing listings at scale.

By spinning off Mainstay with a fresh cap table at a time when SFR investing is regaining interest after a challenging period, the company is strategically positioning itself to capture meaningful market share from the next wave of institutional investor activity. At the same time, Mainstay is introducing practical, user-friendly tools for everyday consumers.

What They Do

While the breadth of services is impressive, there is an opportunity to refine the focus on what Mainstay does best — delivering solutions for institutional investors. The data product is a valuable asset, potentially offering a more refined version of the data available on platforms like Zillow for non-institutional customers. This addresses a critical issue in real estate: the monopolization of data by a few major players (e.g., Data Trace, CoreLogic), which are then repackaged by companies like HouseCanary for specific markets.

By simplifying the process for consumers to access comprehensive information on one platform, Mainstay effectively reduces the information asymmetry that has long plagued the real estate industry.

Where Mainstay excels is in its vertical integration and the solutions it offers institutional investors — solutions that could be adapted for individual investors over time. For institutions, creating an acquisitions function that aligns with their investment strategy is no small feat.

Mainstay addresses several significant industry challenges through its integrated acquisitions platform, including:

In-house title company: This streamlines the closing process for both individual transactions and portfolios, making it more efficient than relying on partnerships.

HOA Review: This ensures investors avoid purchasing homes they cannot rent out or have excessive tenant restrictions/fees, mitigating a common risk in SFR investing.

Property Tax Services: With the acquisition of Tax Proper, Mainstay offers accurate modeling of reassessed property tax amounts, which can impact pro forma targets, particularly in high-tax markets like Texas. Additionally, tax appeals at scale can recover meaningful margins in operating expenses, a benefit that less informed teams might overlook.

Inventory Access: Mainstay’s potential first right of refusal on Opendoor's entire pipeline gives it unparalleled access to arguably the most valuable component in SFR investing: inventory.

The Bottom Line

While the current market positioning and branding (who approved the name change? 😵💫) could benefit from refinement, the underlying business model of Mainstay has so much potential. With one of the best product teams in the industry (we are biased), Mainstay is well-positioned to become a dominant leader in the SFR space for years to come.

If you’re interested in learning more about how you can leverage their data, buy/sell, or how they can support your institution/fund, schedule a demo with the Mainstay team here!

Sales & Marketing roles:

Sales Executive, Pacaso, Los Angeles, CA

Account Executive, Knock, remote

Sales Executive, Divvy, remote

Enterprise Account Executive, Happyco, remote

Enterprise Account Executive, EliseAI, New York, NY

Account Executive (Mid-Market, EST), ApartmentList, remote

Marketing Associate, Social Media, ApartmentList, remote

Performance/Growth Marketing Manager, ApartmentList, remote

Product & Engineering roles:

Senior Product Designer, Properties, Roofstock, remote

Senior Software Engineer, Rental Operations, Roofstock, remote

Senior Product Manager, Backflip, remote

Senior Product Manager (Growth & Demand Gen), Padsplit, remote

Senior Product Manager, Zillow, remote

Operations roles:

Director of Asset Management, Backflip, remote

Chief Operating Officer, Padsplit, remote

Senior Manager, Operations, Pacaso, remote

Program Manager, New Construction, Zillow, remote

Director of Operations, Partnerships, Second Nature, remote

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}

Buy prop.text Swag 🛒

You can buy your own prop.text merchandise

Coming Soon

100% of the proceeds go toward making this the best real estate investment newsletter for our valued readers.