Is the Title Insurance Market Ripe for Disruption?

When Fannie Mae decided to allow for Attorney Opinion Letters (AOL) on certain loan types instead of title insurance, it might have been the biggest shift in the business since the Pennsylvania Supreme Court ruled against a property buyer 168 years ago in a dispute over a lien.

In 1876, the first title insurance company was founded in Philadelphia, and ever since buyers and lenders have dutifully written checks to these companies at closing. These checks are no small expense, anywhere from 0.5-1% of the cost of a home, ranging from $2,000-4,000 on a $400,000 purchase.

The Biden administration has pushed to lower closing costs and make homeownership more accessible and the two government mortgage giants now accept AOLs, saving buyers anywhere from a few hundred to a few thousand dollars at closing.

AOL letters, coupled with insurance, are now considered as reliable as title insurance in many cases. (Title insurance protects buyers and sellers from anyone that has a claim on a property. Title searches are conducted prior to a sale to protect against fraud and to insure there are no outstanding liens.)

“The recent changes in Fannie and Freddie guidance have opened the door to alternatives,” said Spencer Mobley, a partner at Bradley Arant Boult Cummings LLP in Birmingham, Ala., who represents financial services clients to resolve issues with mortgage liens and note obligations. “It was the catalyst.”

The changes at Fannie and Freddie were first introduced in 2022, but Fannie announced in December that AOLs would be accepted more widely, and then Freddie Mac announced in May that it would accept AOLs for condos and on “loans secured by a property subject to restrictive agreements or restrictive covenants.”

Lenders have been in favor of the changes, but the title industry’s trade group, the American Land Title Association, has been a vocal critic.

What’s at Stake? A Multi-billion Dollar Market

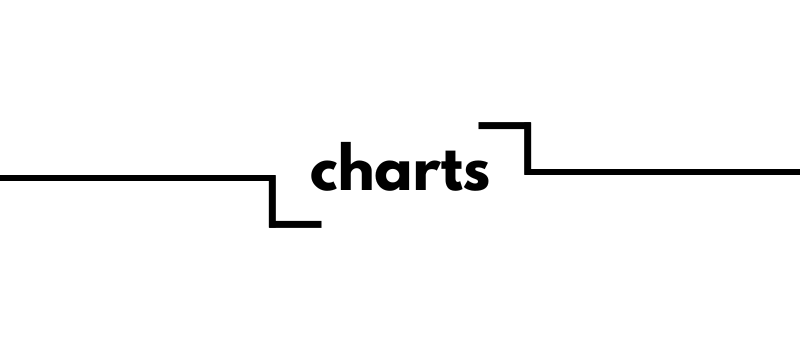

In 2023, the title insurance industry generated $15.1 billion in title insurance premiums, according to the ALTA’s Market Share Analysis, released in late April. In 2022, the title industry generated $21 billion in premiums; the ALTA attributed the 31% drop in premium volume to a decrease in mortgage originations.

Though premiums fell in 2023, largely because home buying slowed, the amount the industry paid out in claims rose, jumping from $596 million in 2022 to $638 million in 2023, according to Housing Wire.

The Federal Housing Finance Agency approved a plan in March to reduce closing costs for homeowners, including waiving the requirement for lender’s title insurance on certain refinances, saying it would save thousands of homeowners up to $1500, and an average of $750

ALTA called the announcement a political gesture offering a false promise of savings for homeowners while exposing consumers, lenders and taxpayers to greater financial risk.

In a white paper published in June by Mobley and his colleague Hallman B. Eady, they wrote this about a product offered by the Alita Group, a company at the forefront of developing alternatives to title insurance:

We have concluded that the AOLPro wrapped with the MSP E&O policy and coupled with a closing protection letter addresses significant title-related risks, including the most commonly encountered title risks, and is poised as a viable option in the modern real estate and mortgage lending landscape.

Are AOLs Safe, and Are They Here to Stay?

Mobley and Eady wrote that the modernized version of the AOL offered by the Alita Group, which the company calls a fully insured attorney opinion letter, “relies on the same title search and exam process that underlies a title insurance policy.” The product includes an attorney review and an Errors & Omissions policy issued by A-rated insurance carriers.

From white paper:

In the same way that title insurance resulted from a need in the market and the ingenuity of market participants, the demand in the current market for more affordable homeownership presents a similar opportunity for ingenuity and a new option for addressing title-related risk, like an insurance-backed AOL.

The policy that backs Alita’s AOL and the closing protection letter provide coverage for the title examination, closing and recording processes, similar to what prospective insureds are accustomed to with title insurance.

At the end of the day, Mobley said “it’s a matter of balancing the risk with the cost” and some would argue that the fees for title insurance are not justified given the risk that there are issues with the title.

Closing Days Ahead for Title Insurance?

Unforeseen events in the future drive the insurance market for autos, boats, homes, or death benefits. Title insurance, conversely, looks back.

“The thing that makes title insurance different than all the other insurances is that it insures the past,” said Spencer Mobley, a partner at Bradley Arant Boult Cummings LLP in Birmingham, Alabama.

In other words, title insurance guarantees against liens on a property that could date back 1, 5 or even 20 years. Title insurers protect against legal claims could come from a previous owner’s failure to pay taxes, or from contractors who say they were not paid for work done on the home before it was sold.

“A title policy does not have a set expiration date,” Mobley added. “It expires when a property is sold.”

The monopoly title insurance has had over the real estate market is now under threat. Fannie Mae and Freddie Mac, the government agencies that provide access to funds to the thousands of banks, savings and loans, and mortgage companies that make loans to finance housing, have moved to accept alternatives to guarantee a title.

They have decided to allow for Attorney Opinion Letters (AOL) on certain loan types instead of title insurance, which has created uncertainty in a market that generated $21 billion in premiums in 2022 and $15.1 billion last year.

The policy goal at work is to lower the costs for buyers and make homeownership more accessible, and AOL letters can save hundreds to thousands of dollars for buyers at closing time.

Unsurprisingly, this shift has not been welcomed by the industry trade group, the American Land Title Association. They have called it “a political gesture offering a false promise of savings for homeowners while exposing consumers, lenders and taxpayers to greater financial risk.”

But AOLs are a long way from loosening the title insurers grip. Fannie Mae purchased just 45 loans with AOLs in 2022, while it purchased a total of 1.151 million loans in that year.

Is It Worth It? Some Buyers Say No

National Public Radio told the story of a buyer in Massachusetts, Peter Ott, who bought his first home in Boston with his partner in 2022.

The title search alone cost only $200, but Ott paid his real estate lawyer about $1,400 to handle other title work and represent him. But they had to buy title coverage for the mortgage, and their lawyer urged them to buy a second policy for themselves.

“Then I also see my lender's title insurance amount. And I believe if I scroll down, I can see my owner's title insurance amount. So roughly those two — it's almost $5,000,” Ott told NPR.

When Ott asked how much of the $5,000 went to his lawyer, he was told 80%, or about $3,800. And NPR said that is typical across the country — big insurers pay lawyers and title agents the majority of the money charged to the home buyer.

Some are crying foul.

“I mean, it's a scam not just in Massachusetts. It's a scam nationwide,” Bruce Marks, who runs a nonprofit that helps people get mortgages called NACA, or Neighborhood Assistance Corporation of America, told NPR. “You know, they get so much of what I call a kickback. You know, you can call it a fee. I believe it's a kickback.”

Federal regulators dropped a requirement for lawyers and title agents to disclose how much they make on insurance fees, and in a half dozen states, including Massachusetts, title rates are not regulated at all.

The History of Title Insurance

The first title company was founded in Philadelphia in 1876, eight years after the Pennsylvania Supreme Court ruled against Mark Watson in Watson v. Muirfield. Charles H. Muirhead had searched and abstracted a property title for Watson and found a lien. He showed the lien to an attorney, who advised the judgment was not a valid lien.

The property was sold at a sheriff’s sale, and Watson lost his $1,4000. The Pennsylvania legislature passed a law in 1868 calling for title insurance, deciding the system to protect buyers was falling short. Before this, purchasing property in the US was a riskier venture.

So the irony is that an attorney’s bad advice gave birth to title insurance, and today attorneys are returning to the scene and trying to disrupt the title insurance market.

That market has grown to be worth tens of billions of dollars a year, and is required by most lenders at closing. The market differs from state to state, as regulations vary. Iowa, for instance, has an exclusive title coverage provider, ITG, that offers lenders and owners low-cost title coverage for Iowa real property. The revenue, minus operating expenses, is reinvested to assist Iowa homebuyers with down payment assistance.

Some counties have digitized their records and the process of searching for liens or other claims on a title can be conducted online, but not every case is so simple.

“There are some places where you have to go down to the courthouse or recorder’s office to pull deeds,” Mobley said.

The digitization process is imperfect as well, he added, because “human error enters the equation. A missed keystroke can lead to mis-indexing.”

AOLs Enter the Picture, And Buyers Can Save

Most lenders require buyers to purchase a lender’s title insurance policy, which covers the amount of the loan. Many buyers also purchase an owner’s title insurance policy, which can protect the financial investment in the home.

Fees vary by state, but a guideline is that title insurance, including the price for the lender and owner policy plus the title search, runs about 0.5% to 1% of the home price. That would be about $1,750 to $3,500 on a $350,000 house. AOLs can save a buyer anywhere from hundreds to thousands of dollars, depending on the cost of the home.

The Alita Group offers a fully insured alternative to title insurance on the market, AOLPro, which offers comprehensive coverage at a reduced cost, saving some buyers thousands of dollars. It is available nationwide on their platform.

David Sober, writing in the real estate publication REI-Ink, said the debate over AOLs vs. title insurance is misguided.

“You do not have to choose sides. Ceasefire, everyone,” wrote Sober, senior vice president at Voxtur Analytics, a real estate technology company. “There is no need to be all-in as a rule on one option or the other. Instead, you can choose which best suits the homebuyer you are helping, based on their situation.”

Sober’s neutral position could reflect some personal bias. Voxtur offers both title insurance and AOLs, but when the two giants Fannie and Freddie decided to allow an alternative to title insurance, a lot in the industry were awakened to the idea that AOLs were a legitimate choice.

Voxtur offers an AOL that carries an insurance policy and a viable alternative to title insurance that is available nationwide, has purchase and refinance options, and owner’s and lender’s coverage. The risks associated with AOLs, according to Sober, are based on outdated assumptions.

“We in the housing industry have a duty to present the best possible option to our clients,” Sober wrote. “It is this fiduciary responsibility that needs to drive our decision-making, and now, armed with all the facts about AOLs and a method to determine the best path forward, we can do just that.”

Atlanta, Georgia

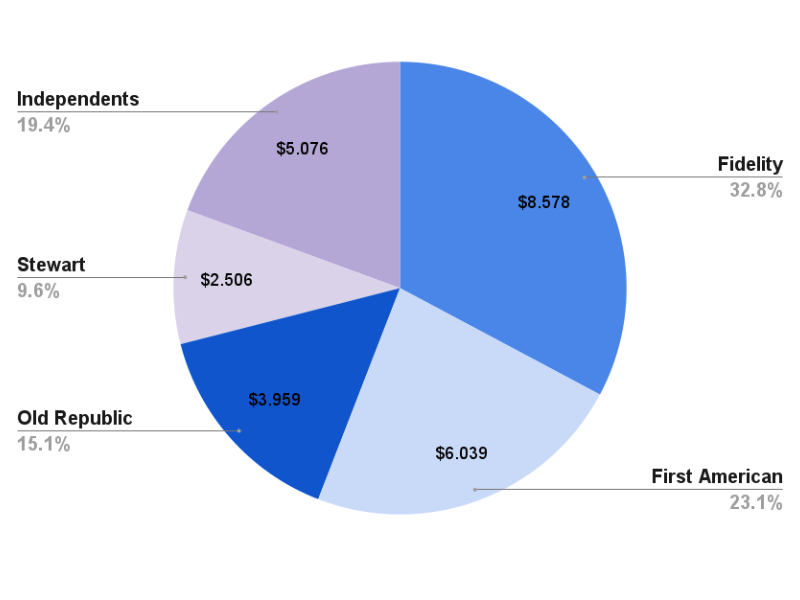

Atlanta is one of the fastest-growing metropolitan areas in the United States, with population increasing by approximately 1.2% from 2022 to 2023, reaching around 6.2 million in the metro area. With this spurt, Atlanta cracked the top six largest metro areas in the US. Strong job creation, a relatively low cost of living compared to other major cities, and an influx of young professionals and families seeking opportunities have fueled its expansion.

Atlanta’s economy is diverse and resilient, and it serves as a major hub for industries such as logistics, technology, film, and financial services. The city’s unemployment rate was 4.5% in June, up from a low of 3.6% last April, which is within the range of what economists consider “full employment.” The city's median household income was $77,655 in 2022, and as of June home prices were up 4.7% compared to last year, selling for a median price of $434,000, according to Redfin.

The rental market in Atlanta is robust, with a significant portion of the population opting for rentals. The median rent for single-family homes in the Atlanta metro area was approximately $2,200 per month as of 2023. The rental vacancy rate hovers around 6.4%, reflecting healthy demand. Additionally, the city’s growing population, coupled with increasing home prices makes Atlanta an attractive market for investors to explore.

Key Neighborhoods

Within the city, West End, East Atlanta, and Kirkwood, are areas that offer a combination of affordability, growth potential, and strong rental demand. West End, for instance, has seen significant redevelopment, attracting young professionals and families. East Atlanta and Kirkwood are similarly appealing, with strong community ties and increasing property values.

However, outside of the city limits but within the metro area, two counties were among the fastest growing counties in the US during 2023.

Jackson County: The population increased from 75,812 in 2020 to 88,615 in 2023, with the city of Jefferson being the second fastest-growing micro area in the U.S. in 2023.

Dawson County: The population increased from 26,796 to 31,732 in 2023, and was fifth in the nation for fastest-growing counties with over 20,000 residents in 2024.

Competing in a Challenging Market

It’s no secret Atlanta's housing market is one of the most competitive. Institutional investors, remote investors and demand from Southern migration means those looking to buy in Atlanta will have to dance outside the traditional buy box. This means shopping for homes that need renovations, looking on the periphery of the metro area, considering small scale build-to-rent, or shifting business strategies to mid-term rentals or co-living models. While Atlanta does attract some tourists, short-term rentals do not look attractive based on the daily rate and occupancy rates.

Some Risks and Other Pitfalls to Avoid

Atanta, more than other cities, suffers from professional squatters. Bloomberg reported that there are “an estimated 1,200 homes are illegally occupied in the Atlanta metro area.” The squatting issue may have quadrupled since the start of the pandemic, an attorney representing institutional investors told Bloomberg story.

Cap rates can look deceiving without taking the risk of squatters into consideration, but there relief might be coming. The state recently passed new legislation intended to counter the squatter issue, but the new legislation won’t alleviate the backlog in the legal system. Removing a squatter in Atlanta can take a year or longer.

376 Golden Eagle

This 5-bedroom, 2.5-bath home in Braselton Townside features an open floor plan, a spacious kitchen with white cabinets, a large island, granite countertops, and stainless steel appliances. The property boasts a large private backyard overlooking the woods and is located in a new swimming pool community just 5 minutes from I-85 and within walking distance to Braselton TownCenter. Chateau Elan Winery and Michelin Raceway Road Atlanta are only 10 minutes away.

The Investment Thesis

→ Located in Jackson County the second fastest-growing micro area in the U.S. in 2023.

→ Close to I-85 in NE ATL and 45 mins to Athens

→ Newly built in 2023

Property Details

Yr Built: 2023 | Type: SFR |

Sqft: 2,380 | Bed/Bath: 5, 2.5 |

Financial Projections

Asking Price: $418,000 | 5 Yr Appreciation: $102,904 |

Revenue: $27,660 | Annual Gross Income: $21,288 |

Interested in Learning More?

*Appreciation based on 4.5% growth rate.

John’s Dream Vermont Compound

When John Van Hook bought a small ski chalet 26 years ago on 1.25 acres on a hill across from his favorite Vermont ski area, he wasn’t thinking of creating a real estate portfolio that would help him achieve a lifelong dream.

“I accidentally fell into it because of the love of the area,” said Van Hook, who rents out a barn he built and is finishing the build of a larger home he plans to rent during holiday periods. “I always wanted to retire to Vermont and was looking for property.”

Back in 1998, property in Vermont was cheap — his first house, a two-bedroom ski chalet, was $115,000 — and there was a lot of available land. He intended to use the house for ski weekends and continue working in the environmental business in the New York area.

“It was a place where I could afford something and I wanted to live,” he said. “It ended up being the best thing I ever did.”

Five years later, he bought the adjacent 1.25 acre lot that had a modular structure on for $35,000, making his total investment $150,000.

“I had zero money,” said Van Hook, who was going through a divorce and had legal fees and child support to contend with.

He ended up moving to Vermont full time in December 2003 and slowly developed the property, doing most of the construction work himself. It’s provided steady income for the last four years.

First came the “Barn,” a 30x40 building with 25-foot ceilings and a 300-square-foot sleeping loft. After four years, he’s close to finishing the main house, a 2,500-square foot three-bedroom and three-bath structure with direct views of two ski areas, Sugarbush and Mad River Glen.

Home prices have shot up in Vermont since before the pandemic, and it shows no sign of letting up. A recent nationwide analysis of home prices from the Federal Housing Finance Agency showed Vermont had the highest year-over-year home appreciation rate of any state, at 12.8%, VtDigger reported in May.

“I would challenge anybody who said that there is another market in the United States that has gone so crazy,” Van Hook said.

This interview has been edited and condensed for clarity.

The Dream Compound

What is your special real estate power?

My special real estate powers ended up being fortuitous timing and dumb luck. I’ve always been very interested in real estate but never had the money to invest. If I had money, I would have been seriously invested in real estate in my mid-30s. I didn’t go into this blind, not knowing anything. When I bought that first place, I literally did not have two nickels to rub together. I came up with $5,000 for the down payment, and I can’t remember where I got it. After being married and divorced I was in the red all the time. I had a love of real estate, it started when I worked with a carpenter. I developed a love for structures and how things were built. It was an architectural interest as well. The love of real estate was more motivated by that than the land.

I used those skills to build both houses. I had in my favor the fact that I did not have a deadline. I could live in one house while I built the other, and I could simply enjoy the building of the other. If it took me 10 years it didn’t matter. I was in a rush to be happy with what I was building.

What was the hardest lesson you learned early on in your real estate journey, and how did you overcome that and persevere?

It took three years to build the one house and I lost one entire year because of Covid because there were materials you could not get. There was no way of foreseeing that.

What advice would you offer to somebody looking to get into real estate or grow a portfolio?

My advice would be different than somebody who is into it just for the money. Make sure that you love what you are doing. You love the land, you love the area where you are going, and the building you are constructing is something you dreamed of. Then when you are done it’s like your dream came true. It was due to a lot of hard work, but I don’t think about the hard work. Make sure it’s something you have a passion for, then you’ll create the knowledge.

Among the strategies a property owner could pursue — long-term rental, mid-term rental or short term, (Airbnb), co-living — what works best for you, and why?

The category of short-term rentals, from one day to one month. You make more money with the short-term rentals. I’ve tried the mid-term rentals and I thought it would be good because I would not have to change sheets, and turn over the place. But those tasks are pretty easy since most people have left my place in good shape, because I allow pets. They rate me and I rate them, so they are conscious of leaving the place clean since they have a pet.

I thought the summer would be a good time to have mid-term rental since it’s easy. [He paid $150 to list the barn on Furnished Finder, which caters to travel nurses and other professionals.] In the winter, you need to shovel the snow, make sure the power does not go out, the heat is working, etc. When the new house is done, it might be different since I’m more comfortable in the barn. The new house is easier to live in. It’s bigger and a more elegant house.

I could vacate it for a few weeks around Christmas and get $15,000 or $20,000. I do have a lot of options because it’s such a special place and is a resort town.

What do you think is the biggest issue investors face in 2024 and beyond?

In Vermont, it’s building costs. If someone is thinking of investing and it involves fixing up a house or building a house, it’s a very tricky time. It’s a bizarre time for building a house in Vermont. People are paying to build a house and they cannot sell that house for a profit after it is done. If you are a handy person, you can fix a place up and material costs have come down. One result is that there are a lot of contractors here that weren’t here before. Some guy bought a hammer and now he says he’s a contractor. There is no state exam for contractors, no regulation, and the people hiring them don’t know what they are getting. But if you can find some property in a peripheral town, outside the resort towns, and you are a handy person, you can get around the issue of building costs.

What’s your sense as to where the market is going, vis a vis, rates, prices, valuations, appreciation, etc.?

I’m not worried about my property decreasing in value. In Vermont, the problem is there is no inventory. It was all bought up during Covid. Those properties have tripled in price. You’d have to keep a keen eye and look for properties that are undervalued. Has the bubble burst? No, but we know that bubbles do burst. With climate change, there are places that have been affected in Vermont in the past two years. Now you have to keep that in mind, the changing weather, that these hundred year floods have happened annually the last two or three years in a row. [Torrential rain damaged towns in northeastern Vermont in late July, and catastrophic flooding hit much of the state in July of 2023.] Your flood insurance is now a game changer. You would want to rethink where you are looking to locate.

Faura

Faura is a first to market data analytics company helping consumers and insurers reduce risk and costs from natural disasters. In a world where adverse weather events increasingly impact the built environment, (e.g., see Tropical Storm Debby) Faura's innovative approach bridges the gap between geographic risk exposure and mitigation strategies, aiming to protect homeowners and stabilize insurance markets in high-risk areas.

How it All Started

Co-founder and CEO, Valkyrie Holmes, is one of those people you meet that leaves a lasting positive impression. She finished high school early, interned at NASA working on predictive analysis for meteor risk, then on to SpaceX for commercial ride sharing, and ultimately landed a grant to pursue sustainability projects. Her passion for sustainability led her to pivot toward the insurance industry, where she saw a significant gap in how risk was assessed and managed.

"Insurance underlies everything we do," Holmes explains, highlighting how it plays an important role in our daily lives and how Faura is making that foundation more resilient.

She did all of this before her 20th birthday. 🤯

How Faura Works for Real Estate Investors

For real estate investors, Faura offers a powerful tool to assess and manage properties in high-risk areas. Faura's platform provides a comprehensive digital risk assessment that evaluates critical aspects of a property’s resilience, including roof integrity, foundation stability, and wildfire defenses. These assessments go beyond mere technical reports, offering actionable plans that help investors enhance the safety and durability of their portfolio. As a result, investors can potentially secure more favorable insurance premiums and manage the growing threat of natural disasters.

In states like Florida, where the risk of hurricanes is high, or California, with its wildfire threats, Faura’s services are particularly valuable. Florida is a great example of why managing risk matters, with its high population growth, booming new construction markets, and consistent annual storm threats, making it a focal point for insurers aiming to mitigate risk in an expanding market. The meltdown of the Florida homeowner’s insurance market was covered in issue #3 of proptext.

The costs of unexpected risks are compounding to near crisis levels in 2024 for homeowners insurance in some states.

How to Get Started with Faura

Getting started with Faura is straightforward. Whether you're a homeowner or a real estate investor, the process begins with filling out a home assessment on Faura's platform. This self-guided home inspection collects data on various aspects of the property, which Faura then analyzes to provide a tailored plan for improving the property’s resilience to natural disasters.

Faura’s integration with insurance companies means that the insights gained from these assessments could directly influence insurance premiums, offering a financial benefit to risk management. By leveraging Faura's analytics, investors not only protect their assets but also contribute to a more stable and resilient insurance market.

The Faura team also recently launched their own climate-focused newsletter, Risky Business!

This newsletter is designed for those who want to stay ahead of the curve in understanding how the insurance industry is adapting to the challenges of our changing climate. Subscribe today to receive insights and updates on the latest trends, data, and strategies shaping the future of insurance.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}

Buy prop.text Swag 🛒

You can buy your own prop.text merchandise

Coming Soon

100% of the proceeds go toward making this the best real estate investment newsletter for our valued readers.