Talk of Housing, but Solutions to Shortage Feel Elusive

The presidential election pitting Vice President Kamala Harris against Former President Trump will be decided some time in the next week, depending on how close the race turns out to be and how long it takes to count the votes.

There is bipartisan agreement that there is a housing shortage in the US, though the parties differ on what caused that shortage and how to fix the problem. The number of homes the country is short also depends on the source, according to the Joint Center for Housing Studies at Harvard; Freddie Mac estimated in 2020 that we were 3.8 million homes short; the National Association of Realtors put it at 5.5 million in 2021; while the National Association of Home Builders pegged the number at 1.5 million in 2021. Some estimates put the number as high as seven million

What’s clear is that affordable homes are even harder to find. The US has a shortage of 7.3 million rental homes affordable and available to renters with extremely low incomes — that is, incomes at or below either the federal poverty guideline or 30% of their area median income, according to a report from the National Low Income Housing Coalition.

The reality is that the housing industry is mostly governed by regulations and approvals at the state and local level. Zoning codes and planning boards are the entities builders are accustomed to dealing with, so it’s hard to say how much policy at the federal level can impact housing, and whether any of the plans outlined below will result in more homes being built.

Here, directly from a Harris campaign press release from Aug. 16 and the 2024 Republican Platform from the convention is August are the official positions (with some light editing):

TRUMP CAMPAIGN

The GOP platform mentions these 4 points:

Reducing Mortgage Rates: By slashing inflation.

Opening Federal Lands: Allowing for new home construction on limited portions of federal lands.

Promoting Homeownership: Through tax incentives and support for first-time buyers.

Cutting Regulations: Removing unnecessary regulations that raise housing costs.

At rallies and other public events, both Trump and his running mate, J.D. Vance, have said that deporting millions of illegal immigrants will open up housing for others and help solve the shortage.

Anybody in the construction industry will say it would be well-nigh impossible to put together building crews without immigrant labor, so a mass deportation could be crippling to the effort to build more homes. Jim Tobin, CEO of the National Association of Home Builders, said one-third of the homebuilding industry’s labor force is foreign born.

The deportation threats could be written off as politics, designed to appeal to Trump’s base and hammer away at an issue — immigration — that favors Republicans. However, interviews with Stephen Miller, a senior Trump aide who will likely be the architect of any deportation effort, reveal that he is very serious about the plan to expel millions. These plans would face numerous legal challenges so it’s hard to say what will happen.

HARRIS CAMPAIGN

Calls for the construction of 3 million new housing units to end the supply shortage.

A tax incentive for building starter homes that would complement the Neighborhood Homes Tax Credit that encourages investment in homes that are difficult to develop or rehabilitate.

Expansion of the existing tax incentive for building affordable rental housing.

A new $40 billion innovation federal fund to spur housing construction.

Cut red tape and needless bureaucracy.

Lowering rent for Americans by taking on corporate and major landlords.

Stop Wall Street investors from buying up homes.

Stop rent-setting data firms from price fixing to raise rents.

3. Providing $25,000 down-payment support for first-time homeowners.

At rallies, Harris leans heavily into the corporate landlord trope, playing up the politics of the evil Wall Street investors competing against the average American looking to buy their first home. Media reports have tapped into this myth as well, though back in April NPR did a story that focused on the shortage of homes and blamed it largely on restrictive zoning that makes it harder to build. (It also cited Minneapolis as a success story, since it updated their zoning to make it easier to build apartments near offices and mass transit. It is building housing at three times the rate of the rest of the US and rents have been flat for seven years.)

Harris’s plan is vague on the details, probably purposefully so, and the number of new homes — three million — feels plucked out of the air. If experienced builders are unable to meet housing demand in the market, it does not bode well if government claims to have the answers. Central planning never works.

Our Take on the Housing Plans

While providing a $25,000 down payment for families to buy their first home might sound good in theory, we can see the problems already, which routinely plague government handout programs:

Fraud. When there is free money to be had, fraudsters find a way to get it. (See Covid fraud statistics: Some $9 billion in payouts are under investigation.

Increased competition for starter homes will drive up prices. (Econ 101.)

$25,000 is a 10% down payment on a $250,000 home. The median home price in the second quarter of 2024 was $412,300.

Building on federal lands has a nice sound to it, and Harris has indicated she would be in favor of it as well — and it is included in the Biden Administration’s housing plan. Given that the federal government owns roughly 28% of the land in the US, and in some states it’s much higher: Some 63% of Utah’s land is federally owned, as are vast tracts of California (45%) and Nevada (80%), among other states.

Rep. John Curtis (R-Utah), who is running for the Senate, has introduced a bill to enable the sale of federal lands to states and local governments to address housing shortages. Sen. Mike Lee (R-Utah) has introduced a companion bill in the Senate.

The problem is where that land is generally located.

The Biden administration effort is focused on “vacant and surplus federal lands that are within existing development zones and in metros that face shortages of affordable housing,” a White House aide told Politico. “Given those careful considerations, the overwhelming majority of federal lands are unsuitable for housing development and not part of our focus.”

Going after rent-data firms is already happening, as proptext.co reported in newsletter number 11, as the US Department of Justice sued RealPage on Aug. 23 alleging its algorithm violates antitrust law. It’s quite clear that the technology genie is out of the bottle and savvy landlords will always find a way to maximize rental returns.

The US is still dealing with the hangover of the 2008 housing crisis, and weak home construction for more than a decade, restrictive building codes, and a period of historically low interest rates have had more impact on housing affordability than any federal government policy.

It’s hard to see how any of that is going to change after the election on Tuesday.

For Avoiding Capital Gains, Think Delaware Statutory Trusts

Most savvy real estate investors are aware that a 1031 Exchange is a vehicle that can help avoid capital gains taxes by swapping one property for another. Not so many are familiar with Delaware Statutory Trusts, investment vehicles that qualify for a 1031 Exchange.

“If you tired of dealing with the tenants, the toilet and the trash,” said Edward Fernandez, president and CEO of 1031 Crowdfunding, a platform where investors can choose what type of property they want to invest in, “then a DST is the way to go.”

“You can still defer the taxes, are still in real estate, and still getting monthly cash flow,” Fernandez added.

A DST is a real estate ownership structure where multiple investors hold a fractional interest in a trust set up by a professional real estate company, referred to as a “DST sponsor” who acquired the assets. DST investments displace the capital the sponsor used to acquire the property until it is eventually owned by the investors.

In the case of 1031 Crowdfunding, its platform offers opportunities in multiple commercial real estate sectors.

“Think of the platform as a shopping mall. The mall has several different storefronts — it has student housing, senior housing, multifamily,” Fernandez said. “Most of our clients are getting out of an asset and have all their eggs in one basket and they want to diversify into multiple baskets.”

What Exactly is a 1031 Exchange?

Named for a section in the tax code, the 1031 Exchange” is a swap of one investment property for another. Also called a like-kind exchange, the transaction is a way to change the form of an investment without cashing out or recognizing a capital gain, allowing it to grow tax-deferred.

There’s no limit on how frequently a 1031 exchange can be executed — and leaving the property to heirs is one way to avoid eventually getting hit with a big tax bill after multiple 1031 Exchanges. (Fernandez refers to this as “swap until you drop.”)

But there are strict rules governing them.

Cannot trade partnership shares, notes, stocks, bonds, certificates of trust or other such items.

Cannot trade investment property for a personal residence,

Cannot trade for a property in a foreign country or “stock in trade.” (Houses built by a developer and offered for sale are considered stock in trade.)

Proceeds from the sale must be held in escrow by a third party, then used to buy the new property; an investor cannot receive the proceeds, even temporarily.

These trades are also subject to strict time limits, and since an exact swap of one property for another is rare, the majority of exchanges are delayed, three-party, or Starker exchanges (named for the first tax case that allowed them):

In a delayed exchange, you need a qualified intermediary (middleman), who holds the cash after you sell your property and uses it to buy the replacement property for you. This three-party exchange is treated as a swap.

45-Day Rule: Once the sale of the property occurs, the intermediary will receive the cash. Within 45 days of the sale of your property, the seller must designate the replacement property in writing to the intermediary.

180-Day Rule: The second timing rule in a delayed exchange states that the closing on the new property must occur within 180 days of the sale of the old property.

Growing popularity of Delaware Statutory Trusts

One of the biggest advantages of investing in a DST to avoid capital gains taxes is that these vehicles are professionally managed and do not require any of the tasks associated with property management. The investor pays a fee upfront and then gets a payout from the trust based on the rate of return and how much money is put in.

According to Kiplinger, other advantages of a DST include:

Lower personal liability

Potential step-up in basis for estate planning

Passive cash flow

No financials or personal loan guarantees needed

Lower minimum investment than wholly owned properties

Real estate diversification

Institutional grade properties

Given the time constraints associated with 1031 Exchanges, DSTs provide relief in that investors can close in as little as 3-5 days. Since the acquired properties are already in a Delaware Statutory Trust, investors can purchase an interest in the trust quickly compared to many other replacement property options.

DSTs carry the same risks as any real estate investment, including potential lack of return and loss of principal. Performance depends on the tenants’ ability to pay rent, and investors do not have personal control over the properties in the trust.

Other risks include:

Lack of liquidity: The investment should be viewed as illiquid while invested in the property. Early exit by the investor for liquidity purposes may not be possible or may be only possible at a significant discount to the trust’s net asset value.

Timing of exit: Generally DSTs have a target property hold period ranging from 3-10 years.

Loan modifications may not be possible: Restructuring the financing of the property may not be possible without changing the legal ownership structure.

Projected cash flow not guaranteed: As with any real estate property investment, cash flow levels are subject to market, economic, tenant and location risk.

Projected appreciation may not occur: Asset appreciation is subject to market, economic, tenant and location risk.

Interest rate risk: Real estate values are impacted by the interest rate environment.

Regulatory risk: DSTs are susceptible to changes in the IRS’s treatment of tax-deferred exchanges.

DST management costs and fees: DST structure provides for management fees to the sponsoring real estate investment company.

Types of Properties Typically Held by a DST

DST properties include the four major types of commercial real estate: multifamily, office, industrial and retail. Other property types, like senior housing, medical office, warehouse and self-storage, are also fair game.

DST real estate is mostly institutional-grade assets with competitive income potential. Because the purchase price usually ranges from $30 million to $100 million, these assets are generally not available to the average individual investor. The fractional ownership offered by a DST makes them accessible.

Although DSTs can contain multiple properties, they typically focus on a single property type. To diversify across different property types, an investor can invest in multiple DSTs.

More sponsors offering DST investments these days and the amount of money flowing into them has grown. According to a report by Real Capital Analytics, DST sales in 2020 reached $4.5 billion, up from $3.3 billion in 2019.

According to Mountain Dell's 2022 market report, securitized 1031 exchange programs, which include DSTs, raised a record $7.4 billion in 2021. In 2023, there was some $5.2 billion invested in DSTs. The falloff was attributed to higher interest rates.

DST Rates of Return Depend on Property Type

A DST’s annual projected rate of return can range from 4-9%, though it can be much higher if a property appreciates. Multifamily properties are lower risk and tend to have lower returns. Higher-risk properties include retail and industrial products.

Upfront costs can range from 8-23 percent of the value of the investment, according to Fernandez. When buying into an Amazon warehouse DST, where costs are fixed and the owner handles any needed repairs, the upfront investment is lower than a Class C multifamily property that needs renovations to be brought up to a Class B level.

Right now, 1031 Crowdfunding lists some 70 properties across multiple sectors, with a total value of up to $1 billion. He acts as the trustee for senior housing, and works with some 50 agents around the country and serves as a broker-adviser on those properties. He has his own team of analyst and underwriters to vet deals.

What Influences the DST Rate Of Return?

Unlike direct real estate investments, where a property might be held for 20 years or even until death, DST investments last only 5-10 years. (Fernandez says he sees time frames of 3-6 years.) The principal investment is returned at the end of the DST's life, and if there is any appreciation in property values, that appreciation will pass through to the investor. (Likewise if the property loses value, the principal return will be lower.)

(The following calculations are from the wealth management firm Realized.)

Most DSTs pay distributions on a monthly basis. Investing $500,000 in a DST that pays 5.5%, would produce an annual return of: (5.5% x $500,000) = $27,500

This is the cash-on-cash return. DSTs typically offer a cash-on-cash return of 5-9% per year, with the potential for additional appreciation.

Yield Vs. Rate Of Return

There is a difference between them, and ROI, or return on investment, is more commonly used in real estate than rate of return.

The 5.5% per year return (above) is the DST’s distribution rate. For bonds, yield is the terminology for cash distributions. But for DSTs, it is called the distribution rate.

The distribution rate is when cash flows, dividends, or distributions are involved during the holding period. Money doesn’t have to go back to the investor to be called a distribution rate. The investor can instead choose to reinvest the distributions.

Yield is a specific rate of return. Total return is the amount realized when the investment is sold and captures interest, capital gains, dividends, and realized distributions.

Calculating Total Return

In addition to cash flow, the total return includes any appreciation of invested principal, which is tied to the appreciation of the DST's properties. If the initial basis appreciated a total of 20% over five years of holding, the principal will have increased to $600,000, or by $100,000.

Adding the cash flow to the appreciation equals total return.

Total cash flow: $27,500 x 5 = $137,500

$100,000 appreciation + $137,500 of cash flow = $237,500

Divide by the original amount invested:

$237,500 / $500,000 = 47.5%

This provides a total return of 47.5%.

Most DSTs will charge a fee upfront, a load fee, and others will charge it on the back end. These fees typically range from 10% to 20% of the equity invested. On the sale of the investment, disposition fees can run anywhere from 0% to 3.5% before closing or third-party brokerage costs and are paid from sale proceeds. For the sake of example, we will use a 3% disposition fee and 1.5% for closing costs.

Disposition fees and closing costs: $600,000 sale price x (3% + 1.5%) = $27,000

$100,000 appreciation + $137,500 of cash flow - $27,000 of disposition fees = $210,500

The total return value:

$210,500 / $500,000 = 42.1%

Total return on the DST with a five-year holding period is 42.1%.

Our Take

DSTs offer some significant advantages over managing real property — no more tracking down a plumber to fix a busted hot water heater. No more chasing tenants who are late on the rent.

But for investors who are accustomed to having control over their property, it’s an adjustment to become a passive investor. And eventually that DST money will need to be reinvested to avoid capital gains, so it’s not a case of plug and play and forget about it.

As with any significant investment, those considering it should consult with their financial advisor or accountant before making any move.

Knoxville, Tennessee

Knoxville, TN, has become a significant target for real estate investors, particularly in single-family rentals (SFR). This popularity is driven by Knoxville's relatively affordable property market compared to the national average and other Tennessee cities. As of late 2024, Knoxville is the second most popular city for real estate investment in the state, making it attractive for both long-term and short-term rentals. The median home price in Knoxville is around $350,404 compared to $431,356 in Nashville.

The Knoxville area is seeing some movement from major employers and expansions within its established corporate sectors. Oak Ridge National Laboratory (ORNL), nearby, is a central employer and research hub, contributing to the economy and job growth in tech and research roles. The University of Tennessee and companies such as Pilot Flying J and TeamHealth further anchor the local economy, creating demand for rental housing. Although there are no major new corporate headquarters announced for Knoxville specifically, there is consistent growth in the sectors represented by healthcare, retail, and energy technology.

Healthcare and government sectors dominate Knoxville's employment landscape. Healthcare alone, anchored by employers like Covenant Health, Summit Medical Group, and Tennova Healthcare, represents a substantial share of the job market. This sector, combined with educational and public service roles at institutions such as the University of Tennessee and ORNL, makes up the largest portion of Knoxville's employment base

Demographics

Key Neighborhoods

Notable neighborhoods undergoing significant transformation include Downtown Knoxville, Bearden, North Knoxville, and West Hills.

Downtown Knoxville: The downtown area is highly sought-after, particularly among young professionals, due to ongoing revitalization and infrastructure upgrades. The area has seen a 20% rise in housing inquiries, as more people are drawn to the proximity to the city's vibrant cultural scene and urban lifestyle.

Bearden: Known for its family-friendly atmosphere and quality schools, Bearden has become increasingly popular, leading to a 6% increase in home values recently. This neighborhood is particularly attractive for families and those seeking suburban amenities close to Knoxville’s city center.

North Knoxville: Experiencing a “renaissance,” North Knoxville has witnessed a 15% increase in property interest, fueled by new developments and renovations. The area appeals to investors and homebuyers seeking historic charm paired with new growth, especially in Old North Knoxville, which saw a 12% surge in demand as historical restorations gain momentum.

West Hills: Located in the suburban western part of the city, West Hills saw a 15% increase in housing supply due to recent construction, meeting the area’s steady demand among families looking for a residential feel with accessible amenities.

Overall, these neighborhoods reflect Knoxville’s dynamic market, with recent appreciation rates citywide averaging around 5-7.7%%. For investors, North Knoxville and Downtown are especially appealing, given their strong demand and revitalization projects. Future growth is projected to continue as Knoxville remains attractive for both residents and businesses, keeping these areas in high demand for the foreseeable future.

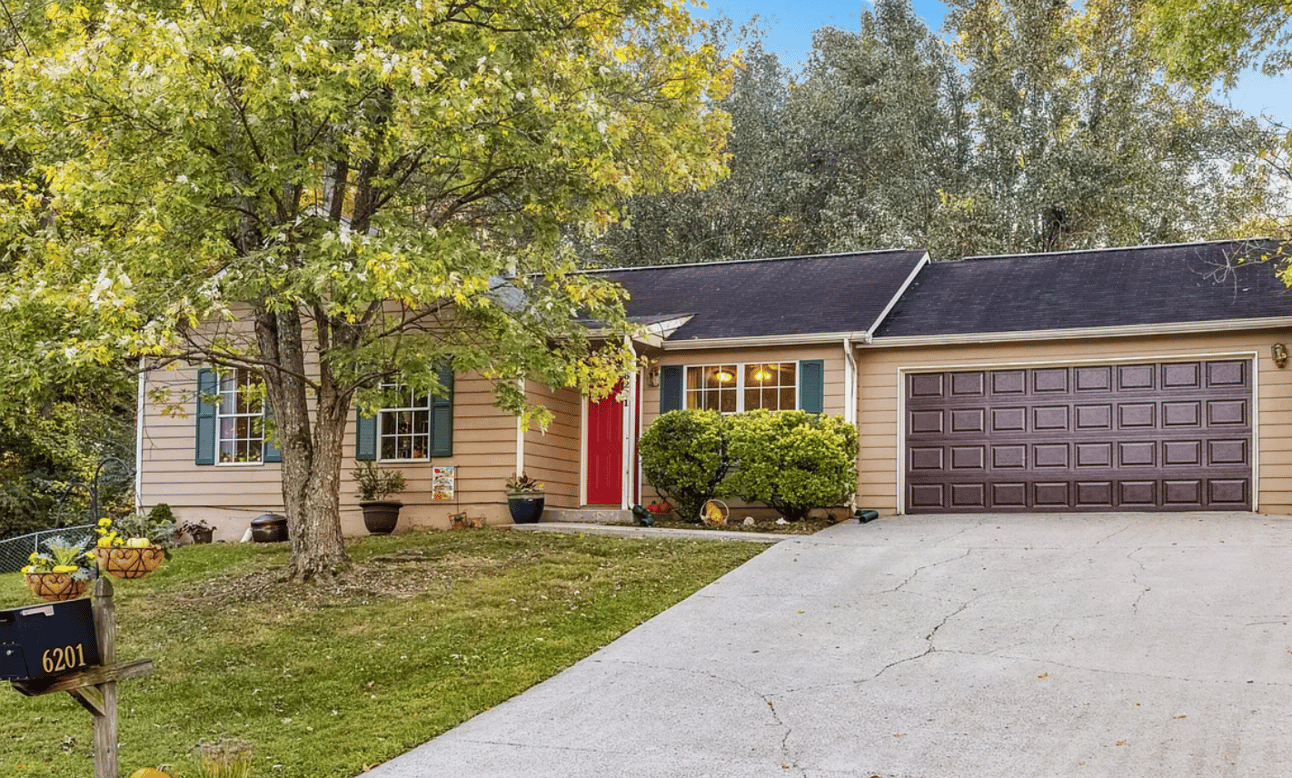

6201 Vandemere Dr

Investment awaits in this 1,000 sq. ft. ranch-style home in central Knoxville. Located on a quiet cul-de-sac, it’s perfect for first-time buyers, downsizers, or investors. With new flooring and close access to schools, parks, shopping, and highways, this property combines convenience with comfort.

The Investment Thesis

→ West of downtown Knoxville this area features easy access to I-40 and I-75

→ Rent growth in this area has seen 3.7% Y-o-Y

→ This part of Knoxville has seen income growth of 19.3% over the past 5 years

→ 6.1% appreciation rate Y-o-Y according to Zillow

Property Details

Yr Built: 1996 | Type: STR |

Sqft: 1,000 | Bed/Bath: 3, 2 |

Financial Projections

Asking Price: $250,000 | 5 Yr Appreciation: $61,545 |

Revenue: $21,240 | Annual Gross Income: $19,971 |

Interested in Learning More?

*Appreciation based on 4.5% growth rate.

Economist Turning Old Hotels into Apartments

Alex Cartwright didn’t have enough money to get into real estate when he was younger — banks would not loan to him — so he bought cars instead.

“I bought several cars and rented them to Uber drivers,” Cartwright said. “I charged a percentage of earnings, bought some insurance coverage, and bought more and more cars.”

He added: “I always wanted to be in real estate but for a lot of different reasons the barriers of entry to real estate were too high for what I wanted to do at a young age.”

Cartwright, who is now an associate professor of economics at Ferris State University in Big Rapids, Michigan, is the founder and managing partner of HotelShift (rebranded from Vilicus Capital) which focuses on hotel to apartment conversions.

“We are converting hotels to affordable workforce housing,” he said. “I also teach economics but I don’t aspire to be the dean or the provost, but I am truly inspired by teaching students.”

Cartwright did his economics research at George Mason University in Fairfax, Virginia, on the legal system to support entrepreneurs, using “real estate as the basis for a several hundred page dissertation on law and property rights.”

Once he finished his PhD at George Mason around 2017, he started buying duplexes.

“I started off with a crappy duplex that was way beneath my income level for what I could afford,” he said, then fixed up one side and used the rent to pay his mortgage. He saved aggressively and kept buying duplexes, then a 14-unit apartment building. He said he’s purchased almost two dozen multifamily properties, all in Grand Rapids, Michigan, near where he teaches in Big Rapids.

Before he started teaching at Ferris State and got into the hotel conversion game, Cartwright took a detour to Peru.

Multiple detours.

“I did a minor in Spanish [at Hampden-Sydney College in Virginia] and had the opportunity to teach in Peru — I’ve been in Peru about 40 times,” he said. While there he rented units and then put them up on Airbnb to earn extra income.

“I started a couple of businesses there and most of them failed,” he added.

Along the way, he became friendly with the Peruvian economist Hernando de Soto, who is known for his research into the informal economy, and business and property rights. De Soto ran for president in 2021, placing 4th, and Cartwright’s friend who had de Soto’s endorsement also lost his run for a congressional seat.

These days he’s focused on hotel conversions.

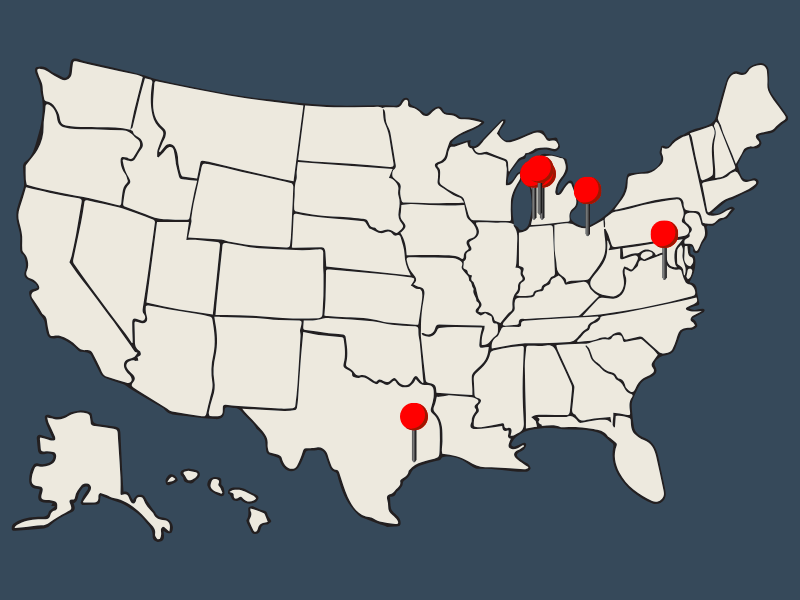

“I”m the lead sponsor on two deals with 250 hotel units in Houston that are being converted to housing right now,” Cartwright said. “We have another couple hundred units in the pipeline in Virginia and Ohio.”

He looks for states and cities — think Phoenix and Denver — with fewer regulations and lower barriers to redeveloping underutilized hotel properties, a sector that has been growing in the last couple years as the number of units that the average worker can rent has shrunk.

According to RentCafe, a total of 4,556 apartments were created from repurposed hotels in 2023. That’s almost 40% more than the previous year and almost double the volume of 2021.

“Ours is a strategy to create nationally affordable housing in places that have high rent and high home prices,” Cartwright said.

This interview has been edited and condensed for clarity.

What is your special real estate power?

Strategy. I want to be an entrepreneur and supply a product that no one has. With our hotel conversion strategy, we’re unlocking a product that has a big upside without taking big risks by buying units that are ready to convert.

What was the hardest lesson you learned early on in your real estate journey, and how did you overcome that and persevere?

The hardest lesson to learn is that you can make all the right decisions and it does not work out. You don’t know what you don’t know, but if you are committed to your goal you get up and do it again. Even the big dogs get knocked down sometimes and have to get back up.

What advice would you offer to somebody looking to get into real estate or grow a portfolio?

You have to make sure that you have an actual investment thesis. I know that 99 percent of actively managed funds do not beat the market over 10 years. If you just have some vanilla-ass strategy you might be better off putting your money into an index fund. You have to have a clear reason why real estate is the vehicle. I’m taking investors’ money and making sure they are getting a return on that money.

For a young person there is almost nothing better you can do than buying a duplex. The ROI (return on investment) on the duplex is probably higher than going to graduate school. I wish a lot more young people would do that.

Among the strategies a property owner could pursue — long-term rental, mid-term rental or short term, (Airbnb), co-living — what works best for you, and why?

Hotel conversions are my strategy for three reasons:

Nobody else is doing it.

Nobody else has a way to create affordable housing so quickly.

We are able to unlock the biggest returns and do it at scale.

What do you think is the biggest issue investors face in 2024 and beyond?

Finding a strategy right that works. There are a lot of strategies that have become really oversaturated. A lot of guys are going out and overpaying for real estate and it’s not paying off. Having some local knowledge can really make a difference.

*sponsored ad this week

Raise capital faster with Agora

In just two quarters, Helu Capital increased their equity raised by 300% with Agora. They effectively marketed new investment opportunities, organized leads efficiently, and provided investors with seamless, customized online subscriptions. They also reduced subscription time by 50% while enhancing investor relations.

With Agora they were able to streamline their operations and achieve operational efficiency allowing them to focus on what matters most - growth.

Sales & Marketing roles:

Account Executive (SMB), Doorloop, Miami, FL

🎉 just raised $100M series B

Sales Lead Manager, Wedgewood Homes, Redondo Beach, CA

Enterprise Account Manager, Happyco, remote

Marketing Manager, Demand Generation, Roofstock, Bay Area, CA

Product & Engineering roles:

Senior Product Manager, Roofstock, remote

Senior Product Manager, Integrations, Second Nature, remote

Senior Software Development Manager, Zillow, remote

Senior Manager, Software Engineering, Costar, Wash. DC

Operations roles:

Sales Operations Manager, Entrata, Lehi, UT

Operations Lead, Services, Airbnb, remote

Operations Lead, Experiences, Airbnb, remote

Revenue Operations Analyst, Unlock Technologies, remote

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}