ZestiNOT What You Think

Mitchell Keller, a retired newspaper reporter and editor, bought a cabin in the Catskill Mountains about 2.5 hours north of New York City some years ago, planning to divide his time between his apartment in the Bronx and his secluded home.

Keller found himself spending most of this time at his place in the woods, enjoying the convenience it afforded him to pursue his love of flyfishing and the solitude for writing projects he’d put off while working a busy editing job at The New York Times.

Now he is considering selling the cabin and making a move, tracking its value through Zillow's Zestimate. He was pleased to see that the value had increased more than doubled, to about $225,000. He had made some improvements to the property, including putting in a water filtration system.

Then he called a real estate agent who has sold property around his town of Margaretville for many years, and he was told the recommended asking price would be between $149,000 and $169,000.

“I was underwhelmed,” Keller said. Based on some research he had done on comparable sales in his area, “I thought he was going to come right in at the Zestimate.”

“I was disappointed,” Keller added. “I thought he came in low, but at the same time I thought he might be right. He knows a lot more about this than I do.”

Business Insider did a deep dive on Zillow’s price estimates and how they are screwing up the homebuying market, and how everybody loves them. We’re going to give you the short version.

How Accurate Are Zestimates?

Keller’s Zestimate experience is not unusual. The reality is “the nationwide median error rate for the Zestimate for on-market homes is 2.4%, while the Zestimate for off-market homes has a median error rate of 7.49%,” according to Zillow.

Pay close attention to the use of median error rate. That means half the homes come within 2.4%, but at least half don’t and Zillow does not offer any details about how far off those home prices are from the Zestimate. It also notes that Zestimates are within 20% of the actual selling price more than 99% of the time.

Within 20%? That’s a pretty big swing when it comes to one of the biggest purchases most Americans make in their lifetimes.

Zillow then recommends: Zestimates are meant to be used informally as starting points, not for real pricing. You should consult real experts for real pricing.

When Zillow launched the first version of Zestimate back in 2006, it was more of a marketing tool than a real effort at home valuations.

“The Zestimate started out fairly inaccurate, but it didn't matter,” Rich Barton, a Zillow cofounder who was then its CEO, recalled in a 2021 podcast episode. “It was provocative.” Spencer Rascoff, another cofounder and former CEO, sold his own home in 2016 for 40% less than its Zestimate.

But when Zillow created its own home-buying arm based on the Zestimate in 2021 — internal algorithms and human analysts valued homes and predicted what they would sell for in a few months, it was no longer a lark. In some cases homeowners received cash offers based on their Zestimate with just a few clicks. When this project lost some $880 million, the division was closed and a quarter of the company’s staff was laid off.

Still, automated valuation models (AVMs) like Zestimate aren’t going anywhere. Zillow competitors, like Redfin, Realtor.com, and Homes.com all have their own versions, and all have their own flaw. After all, algorithms can’t tell if there is a crack in the basement foundation or smell the overpowering mothball scent in the spare bedroom.

So What Should Buyers Trust When Making Deals

Qualified appraisals. Experienced real estate agents. The underwriting of proptext’s amazing team in its weekly Diversification section. Your own field research — from visiting open houses whenever possible.

Real estate agents have mixed feelings about these pricing tools, since they often spur people to want to put their house on the market and cash in. But agents also find they have to explain to sellers why their property did not double in value in the last three years.

The searchability function of Zillow is great, but the data for homes is often out of date, and one of the reasons the Zestimates have limited utility.

Back in 2020, a Wall Street Journal headline blared “Zillow’s Zestimate Is the Algorithm We Love to Hate. Why Can’t We Quit It?” The subhead was more specific: “It isn’t just a measure of our home’s value—it’s a marker of our self-worth.”

And your neighbor’s worth, your boss’s, your friend who lives across town and any number of family members. The Zestimate lets us all put a number on what is often are most visible measurement of wealth

But Zestimate and their AVM are pure marketing, according to Mike DelPrete, a scholar-in-residence at the University of Colorado Boulder who studies the intersection of tech and real estate.

“It's 100% a marketing tool," DelPrete told Business Insider. "Like, not even 99%. It's a marketing tool."

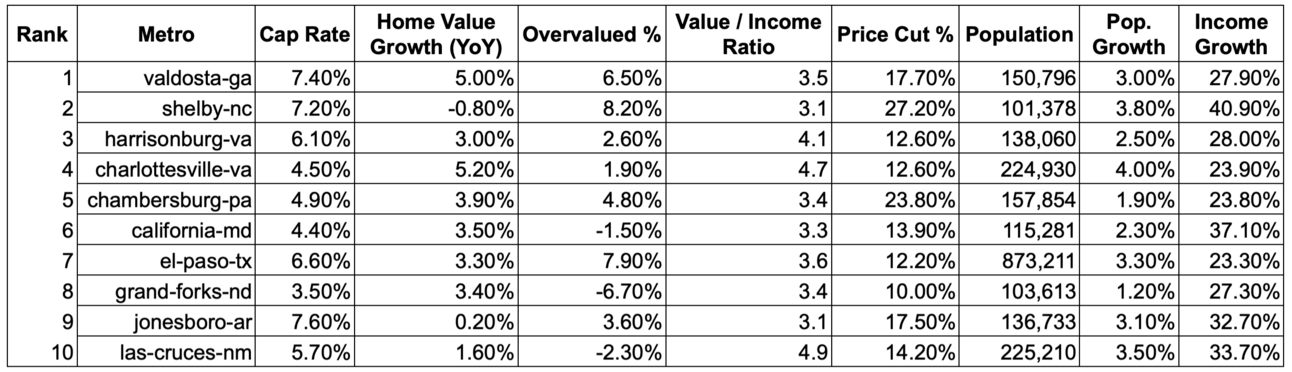

The Not Another Top 10 List of Best Real Estate Markets to Invest in for 2025

It’s January, and ‘tis the season for every real estate newsletter, podcast, media outlet and startup to put out a top 10 list. (The prop.text team knows these lists well, and probably created one or two in previous lives.) They are published because they work: “click here” is the all-time most effective CTAs (call to action) since the internet was born. Prop.text is no different.

Prop.text is making a list too, but ours is different.

Most of these lists will use some fuzzy math to justify once-hot markets like Austin, Atlanta, Charlotte or any city in the Southeast or Southwest.

Other lists will rank the top markets based entirely on a metric like cap rate, which does not capture the full picture of investing in the modern real estate market. Cap rate ignores the largest driver of returns in the past decade: appreciation. Similarly, Buffett valuation metrics like return on equity meant the Oracle of Omaha missed out on Meta, Google, Amazon or tech’s massive cash-generating machines dominating the market today.

So, where does that leave us? Investors can trust a list justifying Atlanta GA for yet another year, or take a look at cities where cap rates rule, though these places often have issues with crime. Those approaches do work for some successful investors. But those looking for an edge that won’t be found in Atlanta, Charlotte, or Phoenix, need to look elsewhere.

Prop.text leveraged US census, Zillow, Redfin and other data providers to select markets based on three specific factors:

Overvalued vs undervalued

Population growth

Income growth

Why these and not rank just based on cap rate?

Overvalued Percentage: Provides a quick view into how hot these markets already are, or aren’t. The overvaluation percentage is calculated by comparing the area's current Value/Income Ratio to the long-term average. Even a slightly overvalued (less than 10%) market with population growth and income growth is more attractive than Charlotte, where the market might be overvalued by 30%.

Population growth: Housing prices are driven by demand, which is a function of population growth. Since prop.text hasn’t sourced data based on household formation rate, we’ve settled for population growth as a proxy for household formation rate.

Income growth: Austin didn’t become Austin just because it saw people moving there in record numbers. Income growth needs to be above the median growth rate in the US to create an attractive market. While we might never see another Austin, we will see some interesting markets where income is outpacing the median national growth rate.

Top 10 Markets for 2025

We used a collection of data and leveraged the Re:venture app, aggregated data together and then filtered out overvalued markets, filtered out small markets (population less than 150k), and filtered down to markets with income and population growth above the median percentage growth across the US.

For example, the median population growth is 1% across all markets. Anything under 1% was filtered out. The median income growth rate over the past 5 years across all 914 markets is 22.9% — anything under this was filtered out.

source: Re:venture, aggregated from US Census Bureau , Zillow, Redfin, US government agencies and others.

1. Valdosta, GA

Moody Air Force Base: Employs approximately 8,000 personnel (military and civilian). Military bases provide consistent demand for housing, including both rentals and sales, as personnel rotate in and out regularly.

Strategic Location: Valdosta is located along Interstate 75, a key transportation corridor connecting Atlanta, GA to Florida's major markets, such as Tampa and Orlando

Growing Interest in Smaller Markets: As larger markets in Georgia (e.g., Atlanta) experience price surges and compressed cap rates, smaller cities like Valdosta offer higher returns and lower competition while still being able benefitting from migration to the Southeast.

Florida Homeowners Insurance Market Upheaval means migration out of Florida, and into other markets. Valdosta should see some influx of Florida residents.

2. Shelby NC

In between two North Carolina cities that have experienced rapid growth, Charlotte and Asheville. Shelby is the more affordable option, and is poised to see some boomers forgo pricer markets and find their way there.

Manufacturing Hub: Shelby and Cleveland County are known for advanced manufacturing, including sectors like automotive components, plastics, and textiles.

3. Harrisonburg VA

James Madison University (JMU): With over 4,000 employees and an enrollment of approximately 22,000 students, JMU is a major economic driver, creating consistent housing demand.

Merck Expansion: The pharmaceutical giant operates a significant manufacturing facility in nearby Elkton. Recently announced a $1 billion investment into their Elkton facility aims to expand vaccine production and add hundreds of jobs.

Half-back migration from Boomers into cities like Harrisonburg VA further boosting future demand for SFR.

4. Charlottesville VA

University of Virginia (UVA): The largest employer in Charlottesville, with over 28,000 employees across education, healthcare, and administration. UVA is also the area’s key economic engine, driving demand for housing among students, faculty, and staff.

UVA Health System: Employs over 13,000 healthcare professionals, serving as a regional medical hub.

Tourism Appeal: Charlottesville’s history, wineries, and proximity to the Blue Ridge Mountains, attracts tourists, supporting short-term rental investments.

5. Chambersburg, PA

Target Distribution Center: A key logistics and warehousing hub in the region, supporting hundreds of jobs.

Food Processing and Manufacturing: Companies such as Ventura Foods and JLG Industries contribute significantly to the manufacturing employment base.

Letterkenny Army Depot: A major employer in defense logistics, supporting 3,000+ jobs and providing economic resilience.

6. California, MD

Naval Air Station Patuxent River (NAS Pax River):The region's primary economic engine, employing over 22,000 military, civilian, and contractor personnel. NAS Pax River is a critical hub for aviation research, development, testing, and evaluation (RDT&E).

Major defense firms such as Lockheed Martin, Northrop Grumman, Boeing, and Booz Allen Hamilton have established significant operations around the base. These companies support thousands of high-paying technical, engineering, and administrative jobs.

60 miles from Washington, D.C.: Provides access to federal government agencies and job opportunities.

7. El Paso, TX

Fort Bliss Army Base: One of the largest military installations in the United States, employing over 38,000 military and civilian personnel.

Manufacturing and Logistics: Companies such as Delphi Technologies, Hoover, and Toro Company have a strong presence.

Growth in nearshoring activities, with manufacturers moving operations from overseas to Mexico and utilizing El Paso as a logistical hub.Expansion of cross-border trade partnerships enhancing employment in logistics, warehousing, and transportation.

8. Grand Forks, ND

LM Wind Power (A GE Renewable Energy Company): A leading manufacturer of wind turbine blades, supporting the region's growing renewable energy sector.

University of North Dakota (UND): The largest employer in the city, with over 3,500 staff members. Renowned for its aerospace and aviation programs, contributing to a skilled workforce and steady rental demand from students and faculty.

Grand Forks Air Force Base (GFAFB): The base plays a central role in drone operations, intelligence, and surveillance, with significant federal investment in unmanned aerial systems (UAS).

9. Jonesboro, AR

Arkansas State University (ASU): over 13,000 students and 1,500 staff members, ASU is a key economic driver and housing market stabilizer.

Consumer Packaged Goods (CPG): Frito-Lay (PepsiCo) operates a large manufacturing plant in Jonesboro. Riceland Foods, a major agricultural processing company specializing in rice and soy products. Nice-Pak Products, a leading manufacturer of wet wipes and related hygiene products.

10. Las Cruces, NM

NASA Test Facility, The NASA White Sands Test Facility (WSTF) provides aerospace testing services and employs a skilled technical workforce.

New Mexico State University (NMSU): A major public university with over 14,000 students and more than 3,000 faculty and staff.

Median home prices are well below the national average, providing investors with low entry barriers and higher ROI potential.

Stanton, Kentucky

Stanton, Kentucky, serves as a gateway to the Red River Gorge, a region where growth is being driven by tourism and real estate development.

Real Estate Market

Median Home Value: As of November 2024, the median listing price in Stanton was $249,900, with a median price per square foot of $158.

Market Trends: The area has seen a 9.1% increase in home values over the past year, reflecting a robust real estate market.

Short-Term Rental (STR) Market

Occupancy Rates: The average occupancy rate for short-term rentals in the Red River Gorge area is approximately 47%, with a daily rate of $216, which translates to an average monthly revenue of $28,733.

Visitor Statistics: The Red River Gorge attracts an average of 200,000 visitors annually, contributing approximately $2 million to the Powell County economy.

Economic Impact: Rock climbers alone account for over 102,000 visits per year, spending an estimated $8.7 million annually in the region.

Main Attractions:

Natural Bridge State Resort Park: Features a natural sandstone arch and offers hiking trails, camping, and a sky lift.

Nada Tunnel: A historic 900-foot tunnel carved through solid sandstone, serving as a unique entryway to the Red River Gorge.

Gladie Visitor Center: Provides information on the cultural heritage and natural history of the Red River Gorge area.

Chimney Top Rock: Offers panoramic views of the gorge and is accessible via a short hiking trail.

A Bright Future for Red River Gorge Area

Infrastructure Developments: Kentucky has allocated $15 million for the development of a destination resort within the Red River Gorge, aiming to attract more visitors and create employment opportunities.

Tourism Growth Projections: Visitor numbers to the Red River Gorge are projected to double by 2030, indicating a growing demand for accommodations and related services.

977 Lower Hatcher Creek Rd

This 80 acre property is located near the Red River Gorge. Property already offers an outdoor pool in a market with few competing pool means this property will immediately standout on Airbnb.

The Investment Thesis

→ Outdoor lovers are flocking to Stanton for Red River Gorge

→ Already offers pool to in a market with few pools to make the Airbnb listing standout.

→ 80 Acres offers the opportunity to build additional units to capture additional bookings

Property Details

Yr Built: 1997 | Type: SFR |

Sqft: 2,068 | Bed/Bath: 4, 2 |

Financial Projections

Asking Price: $570,000 | 5 Yr Appreciation: $123,492 |

Revenue: $54,280 | Annual Gross Income: $40,373 |

Interested in Learning More?

*Appreciation based on 4% growth rate.

Seattle Bus Route Leads to a 10-Unit Portfolio

Hal Colombo was hitchhiking around the country “in the hippie era of my life,” and driving a bus for an adventure travel tour company when he found himself spending a day here and there in Seattle. It didn’t take long before he “fell in love with the place.”

This was back in the 1980s and several years later the New Jersey native inherited a house back east from his grandparents. In 1991, a friend was trying to buy a 4-plex in the Capitol Hill neighborhood, and when that deal fell through Colombo stepped in. The price was the same he sold the New Jersey property for: $175,000.

Fast forward 30 years or so and he now owns ten doors in Seattle, including a 68-square-foot short-term rental he built in his backyard, tricked out with a retracting Murphy-style bed attached to an automatic garage door track. (There is a video tour of the house available on Vimeo.)

Asked if he envisioned making his living buying and managing real estate, Colombo was incredulous.

“Fuck no,” he said. “It was the last thing I ever wanted to do. It turns out it’s a life that finds you.”

He dropped out after a year at Hampshire College in Massachusetts, a school founded in 1965 to radically alter liberal arts education, where grades and structured courses were not part of the curriculum. Even that environment proved too constricting to Colombo, a marginal high school student at best who probably did not have the grades to get in there.

“My mom had amazing persuasive powers and she talked them into taking me in,” he said. “It was the perfect place for me to figure out I didn’t want to go to school anymore.”

The four-plex would serve as his home base while he pursued his freewheeling lifestyle.

“I was going to keep up my traveling lifestyle and keep the smallest place for myself and I’d have a building that will pay for itself,” he said.

He speculates that it probably had some history as a brothel, with its four small bedrooms off the upstairs hallway. “Seattle has a long history with whorehouses,” he said.

“It was my first remodel and the interior was all cut up,” he added. “I tore down walls, I did the floors, added walls, tore out the kitchen and put in a bathroom. I like making stuff and this was the first time I did stuff that was bigger than me.”

Around 2000, his mother loaned him some money and he bought a house in the Fremont district, then built a separate residence in the back for himself over several years with the help of a friend who was a concrete foreman. He moved into that house around 2002 and rented out the front house.

Around 2010, with his mom growing ill and needing full-time help, he bought a house in foreclosure in the Ballard neighborhood.

“That house was in good shape — the people who lost it had just renovated it,” Colombo said. “The house went up for auction and I got it for $365,000. It’s probably worth about $1.5 million today.”

He later financed a house for a friend in the Port Orchard neighborhood, which is just west of Seattle and across from the Bremerton shipyard. He recently co-purchased a home with a neighbor to the south of both their properties, mostly so they could gain control of the air rights and prevent a seven-story building from going in there. They rent that out.

His real estate journey has been mostly unplanned, but has worked out.

“The truth of the matter is I got unlucky and lucky,” he said. “My whole family died off but they did not leave me broke.”

His strategy as a landlord is simple: “I keep my rents below market. I’d rather have somebody stay a long time and not complain about every little thing.”

This interview has been edited and condensed for clarity.

What is your special real estate superpower?

I’d say it’s being patient with people, dealing with the tenants and staying calm. Also, when looking at property is it a piece of real estate that you would want to live in? If you are doing it for the money to turn a quick buck, why would people want to move in? I’m good at recognizing what’s good or building stuff that’s good.

What was the hardest lesson you learned early on in your real estate journey, and how did you overcome that and persevere?

There are times when shit comes up and you need to deal with it right there. You need to realize that your time is not necessarily your own. The property is telling you when you are working. That was kind of hard for me. The roof’s leaking or whatever and you need to deal with it right then.

What advice would you offer to somebody looking to get into real estate or grow a portfolio?

I would say that you need to assume it’s going to be work. Don’t think it’s going to be free money. It’s going to be a lot of new stuff, and a lot of challenges and you’re going to have to deal with it all. I lucked into it by having some generational wealth. A lot of it’s going to hinge on luck. You can do all the research and find the right property, and then suddenly the biggest employer leaves and all the stores close and there’s not much you can do about it.

Among the strategies a property owner could pursue — long-term rental, mid-term rental or short term, (Airbnb), co-living — what works best for you, and why?

I do multiple strategies. The best return for the least work is a long-term rental if you have good steady tenants that don’t eat up your time. So you’re going to have more free time. I do all my own cleaning and repairs to my buildings. At the end of the year if I look at how much time I put in for Airbnbs, it’s probably the most amount of work I do to make money. Am I hiring a cleaner and a manager to run the cleaners? I’m not getting to that point yet.

What do you think is the biggest issue investors face in 2025 and beyond?

At this point I think the market’s overpriced but it seems to keep going up. The market is so split — there is only a market for building houses for the wealthy. The only affordable housing is way out of town and there are these HOAs that are out of control. The governmental regulations as far as tenant protections — it’s getting to the point where a lot of investors are selling and the only people who can afford to invest are those that have their own legal department. The days of mom and pop investing are really getting pressured.

IntelliHost

The short-term rental industry is more competitive than ever, with platforms prioritizing listings that attract engagement and deliver value to guests. For hosts aiming to stand out, IntelliHost offers a solution to optimize listings and boost performance with actionable, data-driven insights.

What Pain Does IntelliHost Relieve?

Short-term rental hosts face several challenges, including:

Low Visibility: Airbnb’s search algorithms prioritize high-performing listings, making it difficult for under-optimized properties to gain traction.

Inefficient Pricing Strategies: Static pricing can leave money on the table or reduce occupancy rates. Dynamic pricing is essential but time-consuming without the right tools.

Lack of Data Insights: Hosts often operate without a clear understanding of how their listings compare to competitors or how changes impact performance.

Manual Effort: Constantly monitoring and adjusting listings can be overwhelming, especially for those managing multiple properties.

IntelliHost addresses these pain points with a suite of tools designed to provide clarity, improve efficiency, and maximize revenue.

Why It Makes Sense for Short-Term Rental Investors

Performance Optimization: IntelliHost’s performance dashboard tracks critical metrics like impressions, click-through rates, and bookings, enabling hosts to identify and resolve issues quickly. The automated change tracker records updates to listings and correlates them with performance shifts, offering feedback on what works.

Competitive Benchmarking: By comparing your property to local competitors, IntelliHost reveals trends in pricing, occupancy, and guest preferences. These insights allow investors to stay competitive in any market.

Dynamic Pricing: IntelliHost’s predictive pricing tools analyze demand fluctuations and competitor data to recommend optimal pricing. This feature helps maximize revenue and boost occupancy rates.

Actionable Recommendations: The platform goes beyond analytics, providing tailored suggestions for improving listing descriptions, updating visuals, and refining amenities. These steps help hosts align with market demands and guest expectations.

Time Savings: IntelliHost automates many of the repetitive tasks associated with managing listings, freeing up hosts to focus on guest satisfaction and other priorities.

How to Get Started

Getting started with IntelliHost is simple and user-friendly:

Sign Up for a Free Trial: Explore the platform’s features with no upfront commitment. This trial allows hosts to experience how IntelliHost can transform their listings.

Connect Your Listings: Sync your Airbnb properties to IntelliHost’s platform for immediate access to performance data and insights.

Implement Recommendations: Begin optimizing your listings using IntelliHost’s actionable suggestions and dynamic pricing tools.

Monitor Results: Use the performance dashboard to track improvements and refine strategies. IntelliHost’s customer support team can assist with any questions or challenges.

Final Thoughts

For short-term rental investors, IntelliHost is a practical solution to the challenges of managing and optimizing listings in a competitive market. By leveraging data analytics, automation, and actionable insights, hosts can improve visibility, increase occupancy rates, and boost revenue.

Sales & Marketing roles:

Enterprise Account Executive, Dealpath, Los Angeles, CA

Senior Vice President of Sales, Fetch, New York, NY

Senior Sales Manager, Placemakr, Pittsburgh, PA

Enterprise Account Executive, Built Technologies, remote

Product & Engineering roles:

Product Manager, Retail Growth, Roofstock, remote

Staff Software Engineer, Built Technologies, remote

Associate Product Manager, Funnel Leasing, remote

Senior Engineering Manager (AI), Compass, multiple locations

Operations roles:

Strategic Customer Success Manager, HappyCo, remote

Senior Salesforce Administrator, SmartRent, Scottsdale, AZ

Sales Strategy & Operations Lead, Opendoor, San Francisco, CA

Director of Revenue Operations, Proof, remote

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}